From January 2025, ships calling at European ports will be subject to the new FuelEU Maritime regulations, establishing the region’s first GHG intensity targets for marine fuels, and accompanied by a complex framework of penalties, rewards, and options for reallocating emissions deficits and surpluses. In preparation, Accelleron is introducing new digital functionality to simplify the additional reporting burden and give operators the forecasting tools they need to reduce compliance costs.

FuelEU Maritime regulation is designed to progressively decrease the GHG intensity of maritime fuels within the European Economic Area (EEA), covering not only carbon dioxide but also methane and nitrous oxide emissions. Crucially, and in contrast to the EU Emissions Trading System (EU ETS), this encompasses energy intensity across the entire fuel lifecycle, on a well-to-wake (WtW) basis, rather than just those emissions produced in ship operations, known as tank-to-wake (TtW) emissions.

The regulation stipulates increasingly stringent annual limits for GHG intensity across all voyages in the region. How is it calculated? Current GHG intensity will be compared to the average intensity of ship emissions within the EEA in 2020, a baseline of 91.16 g of CO2 per megajoule (MJ). Beginning in 2025, ships will be expected to achieve a 2% reduction compared to 2020. In 2030 that will rise to 6%, and it will increase every five years to reach 80% by 2050.

FuelEU will apply to all vessels over 5,000 GT that call at ports within the EEA, irrespective of their origin. The regulation covers 100% of energy used on voyages within the EEA or while berthed at EEA ports, and 50% of the energy used on voyages between EEA and non-EEA ports.

To support customers in reporting accurately and easily, Accelleron’s Tekomar XPERT emissions module will allow for calculation and reporting of WtW emissions. Combined with the platform’s existing capabilities for TtW emissions reporting – which is used to report on emissions for the EU ETS as well as the IMO’s Data Collection System – the new WtW function enables ship operators to fully account for different types and sources of fuels.

Accelleron’s digital services will also help ship operators to identify potential savings in fuel consumption and emissions, providing insights that are vital to planning cost-effective FuelEU compliance. Each year, shipping companies will need to report their compliance balance for the year. If the GHG intensity is above the limit, operators must pay a penalty based on the compliance deficit, which is the difference between actual and required GHG intensity, and multiplied by the amount of energy used. Conversely, vessels that operate within their limits will amass a surplus that can offset future deficits.

The regulation also introduces several flexible mechanisms that companies can use to adjust their exposure to penalties. A voluntary pooling mechanism, for example, allows multiple companies to amalgamate their compliance balances, meaning that over-compliant vessels can lend some of their surplus to non-compliant vessels (also at other companies) to minimize or eliminate penalties. A mandate for zero-emission technologies at berth has also been introduced, requiring passenger ships and containerships to use onshore power supplies (OPS) or equivalent technologies in ports.

The cost of compliance

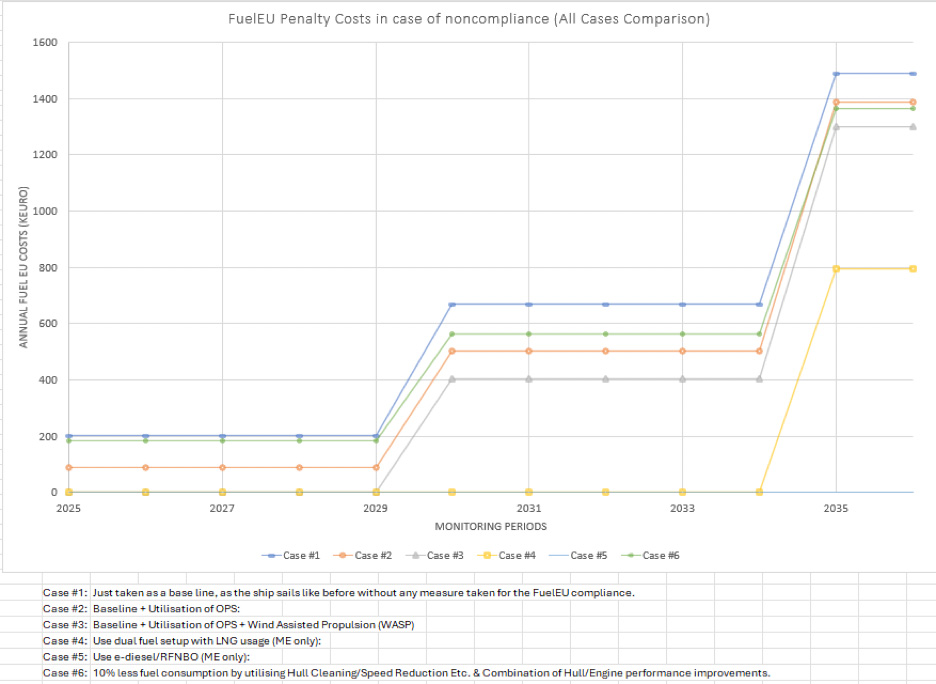

To understand the financial impact of FuelEU Maritime, Accelleron performed a case study based on the 2023 MRV data of a vessel already using Accelleron’s Emissions Module – a 15-year-old, 37,000 DWT tanker. Different scenarios highlight options for mitigating financial risk, by forecasting compliance balances and related penalty costs from 2025 to 2030.

The vessel’s fuel consumption in 2023 was 3,500 tons of low-sulfur fuel oil and 750 tons of marine diesel oil or marine gas oil annually. The ship’s intra-EU trading pattern means that 100% of fuel would be accounted for under FuelEU Maritime. Total annual energy consumption for each scenario is kept constant, to simplify comparison and highlight the evolution of penalty exposure.

In the baseline scenario (Case 1), the ship sails as before, with no changes. In 2025, this leads to the ship exceeding its energy intensity limit by 316 tons of CO2eq, incurring a penalty of €203,000. This penalty increases further after 2030, when the FuelEU Maritime reduction requirement is increased from 2% to 6%.

Further cases show that using onshore power to substitute a portion of conventional fuel (Case 2) or using wind-assisted propulsion (Case 3) would be effective in mitigating financial risk in the early years of FuelEU Maritime. However, from 2030, these measures will be insufficient to avoid large penalties for ships running on conventional fuels.

So, switching to fuels with lower GHG intensity will be essential, and cases that show the impact of replacing main engine fuel with LNG (Case 4) or e-diesel (Case 5) highlight that trend. LNG can cut GHG emissions by up to 25%, helping to meet reduction requirements well into the next decade, until the infrastructure for carbon-neutral fuels is more robust. Even now, E-diesel and other renewable fuels of non-biological origin (RFNBO) can achieve zero well-to-wake emissions, depending on the feedstock used, production method and supply chain.

Using digital tools to optimize efficiency and cut fuel consumption can also offer significant emissions reductions and provide a powerful mechanism to limit financial risk in the early years of FuelEU Maritime. Case 6 shows the impact of a 10% fuel reduction in a conventionally fueled vessel, achieved through digital insights and vessel optimization, including hull and propellor monitoring and cleaning, load reduction, and engine optimization. As with onshore power or wind-assisted propulsion, vessel optimization will need to be combined with low GHG intensity fuels in later years to avoid high penalties.

The table below shows each scenario and the corresponding penalties in 2025, with the line chart tracking the increase in FuelEU Maritime penalties in subsequent years.

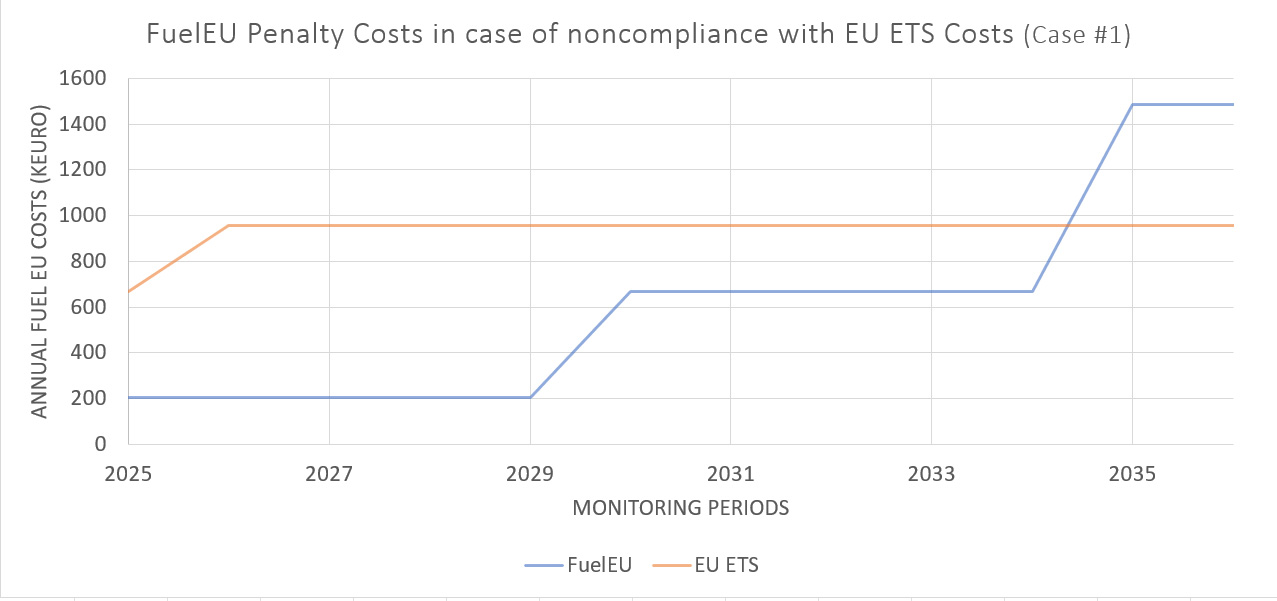

Alongside FuelEU Maritime penalties, the cost of surrendering EU ETS allowances will also need to be considered. The chart below shows the combined impact of FuelEU Maritime penalties and EU ETS carbon pricing for the baseline case, assuming an average price of €70 per EU ETS carbon allowance. It is clear that FuelEU Maritime penalties will overtake EU ETS costs by 2035.

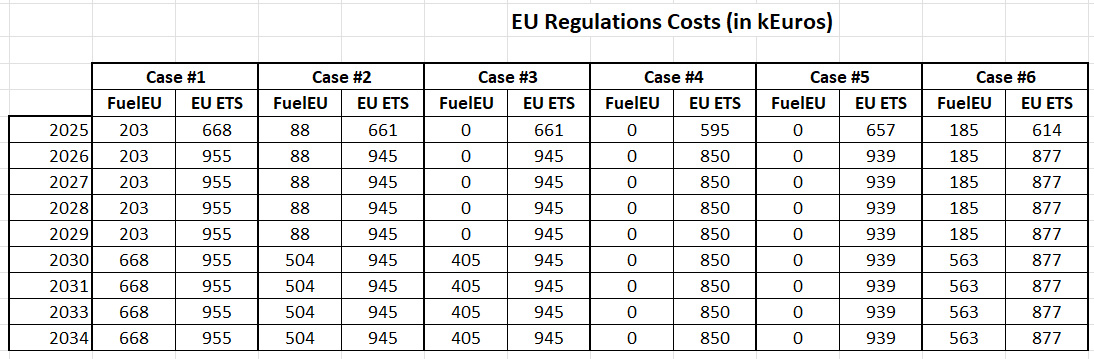

The below table summarizes the combined EU ETS and FuelEU Maritime costs for each case over the coming decade.

Using digital services to plan ahead

Given the combined impact of FuelEU Maritime and the EU ETS, digital services are becoming vital for optimizing vessel performance, easing the burden of emissions reporting, and providing data-driven insights for planning and budgeting across fleets.

Accelleron supports compliance reporting for both FuelEU Maritime and the EU ETS with its new full-lifecycle, WtW emissions accounting and the ability to track voyages and port stays within the EEA. Accelleron’s digital tools connect and transmit instantly and securely from ships to central dashboards, and data validation services allow reports to be corrected before submission. Automated forecasts for fuel consumption and emissions also allow operators to calculate compliance balances and penalties in advance, so that they can make informed decisions on pooling, borrowing or banking surpluses.

While FuelEU Maritime can be complex and costly, it also offers opportunities for operators that use data to plan ahead. Digital services are the key to unlocking those opportunities.

Are you ready to start planning for FuelEU Maritime and EU ETS? Come visit us at SMM Hamburg 2024, Hall A3, Booth 210, and let’s talk!

Image credit: Shutterstock/GreenOak